As a teenager, learning how to save money is a vital skill that sets the foundation for a secure financial future. Whether you’re aiming to buy your first car, planning for college, or just want to have some cash for a rainy day, understanding the art of saving is key. Saving money as a teenager can be challenging, given the temptations of immediate gratification and peer pressure. However, with the right strategies and a bit of discipline, it’s not only possible but can also be quite rewarding. Dive into this comprehensive guide to discover practical tips and tricks on how to save money as a teenager, making your financial goals a reality.

Table of Contents

Introduction

Embarking on the journey of saving money is like planting a seed for your future financial tree. As a teenager, you might think that saving is a chore, but it’s actually a powerful step towards independence. It’s about more than just stashing away a few bucks; it’s about cultivating a mindset that can lead to lifelong financial well-being. In this guide, we’ll explore the ins and outs of how to save money as a teenager, providing you with actionable advice that you can start applying today.

Why Start Saving Young?

Starting early gives you a head start on understanding money management, and it’s an excellent way to practice self-discipline. By saving money, you’re also preparing for unexpected expenses and learning the value of money. Let’s break it down:

- Early habits: Developing the habit of saving early on can influence your financial decisions positively in the long run.

- Compound interest: The earlier you save, the more you can benefit from compound interest – that’s money earning money!

- Financial goals: Whether it’s a new gadget or post-secondary education, saving can help you achieve your goals without the burden of debt.

So, let’s gear up and dive into the world of savings, shall we?

Understanding the Importance of Saving

Knowing how to save money as a teenager isn’t just about the dollars in your bank account; it’s about empowering yourself for the future. Saving money teaches you valuable life skills such as prioritizing, making informed decisions, and delaying gratification. It’s the financial equivalent of eating your veggies – it might not always be fun, but it’s good for you!

Why Saving Matters

Let’s face it, life can throw some curveballs, and having a financial cushion can help you knock them out of the park. Here’s why saving is a big deal:

- Emergency fund: Unexpected expenses? No problem. A savings stash can help you handle them without stress.

- Financial freedom: Saving money gives you the freedom to make choices that aren’t dictated by an empty wallet.

- Education: Dreaming of college or a vocational school? Savings can help you get there without a mountain of debt.

Remember, every penny saved today is a step towards a more secure tomorrow.

Setting Realistic Financial Goals

When it comes to saving money, having goals is like having a destination on a map. Without them, you’re just wandering around with your cash. Setting financial goals gives you a clear target and motivates you to stick to your savings plan.

How to Set Achievable Goals

Here’s the deal on setting goals that won’t make you want to give up:

- Be specific: Vague goals are hard to reach. Instead of saying “I want to save money,” try “I want to save $500 for a new laptop.”

- Make them measurable: Track your progress. Seeing those numbers go up can be a real motivator!

- Keep them realistic: Aim for goals that challenge you but aren’t impossible. You’re going for progress, not perfection.

Whether it’s saving for a car, a concert, or college, having clear goals will keep you focused and excited about saving.

Creating a Budget and Tracking Expenses

Think of a budget as your financial GPS; it helps you navigate where your money should go. As a teen, creating a budget might seem tedious, but it’s actually a secret weapon for saving money.

Building Your Budget Blueprint

Here’s how to create a budget that doesn’t feel like a straightjacket:

- Income: Start by figuring out how much money you have coming in, whether it’s from a part-time job, allowance, or gifts.

- Expenses: List out your regular expenses, like phone bills, snacks, and entertainment. Don’t forget to include the occasional splurge!

- Savings: Decide on a percentage of your income to save. Even 10-15% can add up over time.

Once you’ve got your budget, stick to it! Use apps or a simple spreadsheet to keep track of your expenses and adjust as needed.

Smart Spending Habits

Saving money isn’t just about what you put away; it’s also about how you spend what you’ve got. Developing smart spending habits is crucial when learning how to save money as a teenager.

Spending Wisely

Here’s the scoop on spending that won’t sabotage your savings:

- Needs vs. Wants: Before you buy, ask yourself if it’s a need or a want. Needs get priority; wants can wait.

- Shop around: Don’t just buy the first thing you see. Compare prices and look for deals.

- Discounts and coupons: Keep an eye out for student discounts and coupons. A little effort can lead to big savings.

Remember, every smart spending decision is more cash in your savings jar.

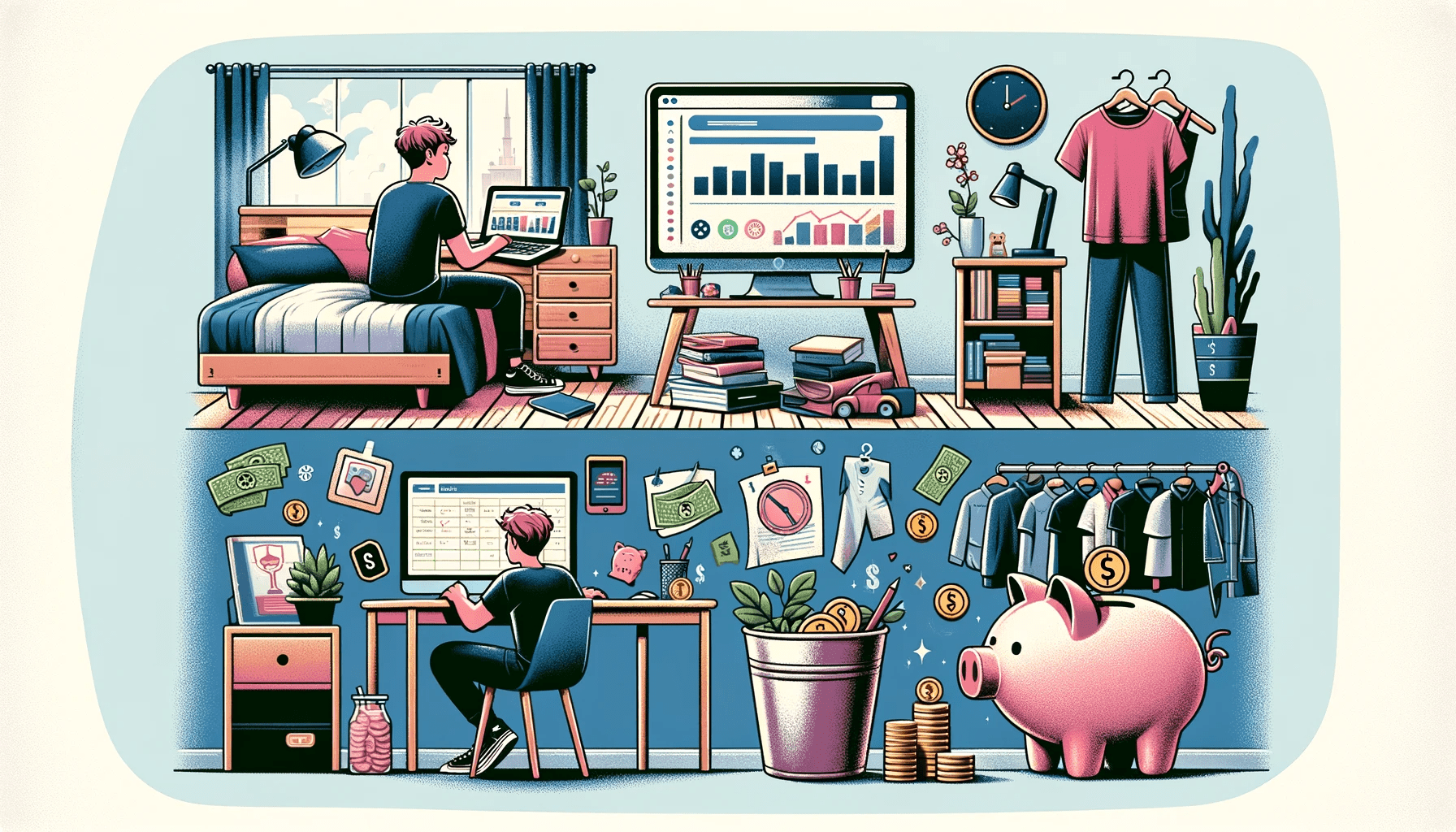

Money-Making Ideas for Teens

Boosting your income is like putting your savings on the fast track. When you’re figuring out how to save money as a teenager, don’t overlook the power of earning more.

Get Creative with Cash

Here are some nifty ways to make extra dough:

- Part-time job: The classic go-to for earning money. Retail, food service, or tutoring can be great options.

- Freelancing: Got a skill? Use it! Writing, graphic design, or coding can all be done on a freelance basis.

- Sell online: Clear out your closet and sell items you no longer need on platforms like eBay or Depop.

Every extra dollar you earn can be funneled into your savings, getting you closer to your financial goals.

Conclusion

Mastering how to save money as a teenager is like unlocking a secret level in the game of life. It might seem challenging at first, but with the right mindset and strategies, you can build a savings account that would make any adult jealous. Remember, every small step you take now is a leap towards a financially secure future. So, set those goals, budget like a boss, spend smart, and find creative ways to boost your income. Your future self will thank you!

Leave a Reply